The Remission of Duties and Taxes on Exported Products (RoDTEP)

Centre Notifies RoDTEP Scheme Guidelines and Rates Scheme to boost our exports & competitiveness Sectors like Marine, Agriculture, Leather, Gems & Jewellery, Automobile, Plastics, Electrical / Electronics, Machinery get the benefits of Scheme.

Rates of RoDTEP to cover 8555 tariff lines

The Remission of Duties and Taxes on Exported Products (RoDTEP) came into effect on 1 January, but guidelines and rates for export items were not announced then. The commerce ministry notified RoDTEP rates on 17 August.

RoDTEP refund range (in%)

| Textiles | 0.5-4.3 | 8,555 |

| Food | 0.5-2.5 | The number of products in India’s export basket that are likely to get the benefit |

| Plastics and rubber | 0.5-2.4 | |

| Aluminum and Zinc | 0.5-2.3 | |

| Machinery | 0.5-2.2 | |

| Auto and ancillaries Products of chemical | 0.5-2.0 | Rs.12,454 crore The total amount the refund is expected to cost |

| or allied industries | 0.5-1.7 | |

| Gems and jewellery | 0.01 | |

1.What is RoDTEP scheme?

The Remission of Duties and Taxes on Exported Products (RoDTEP) scheme reimburses central, state and local taxes that are not refunded under any other scheme to exporters. Under existing rules, goods and services tax (GST) and customs duties for inputs required to manufacture export products are either exempted or refunded. However, certain duties are outside the ambit of GST and are not refunded to exporters, such as value-added tax on transportation fuel, mandi tax and duty on electricity for manufacturing. RoDTEP has replaced the earlier Merchandise Exports from India Scheme (MEIS).

2.What are the features of the scheme?

The scheme came into effect on 1 January, but since guidelines and rates for export items were not announced, exporters were unable to benefit from it. The commerce ministry notified RoDTEP rates on 17 August. The scheme, with a budget of Rs. 12,454 crore for FY22, will be available for 8,555 export items in sectors such as marine, agriculture, leather, gems and jewellery, automobiles, plastics, electrical and electronics, and machinery. The government has announced a separate Rebate of State and Central Levies and Taxes (RoSCTL) scheme for garment exports with a budget outlay of around Rs. 6,946 crore for FY22.

3.Are some sectors excluded from RoDTEP?

Yes; exporters in sectors like iron and steel, mineral products, pharmaceuticals and chemicals have been kept out of the scheme because the Centre thinks the sectors are doing well on their own and given the tight fiscal situation, it won’t be possible to cover these sectors in FY22. Products manufactured in export-oriented units and special economic zones are also not covered.

4.How does the new scheme work?

The refunds for the taxes paid by exporters under the scheme would be credited to an exporter’s ledger account with the customs, and can be used to pay basic customs duty on imported goods. The credits can also be transferred to other importers. The rebate will have to be claimed as a percentage of the freight-on-board value of exports. For certain export items, a fixed quantum of rebate amount per unit may also be notified. A monitoring and audit mechanism has been put in place to physically verify the records on a sample basis.

Share

Subscribe

More articles

Navigating Internal Audit Dynamics In The Pharmaceutical Landscape

Unconventional Ratios For Understanding Conventional Business

Navigating Business Demand Volatility

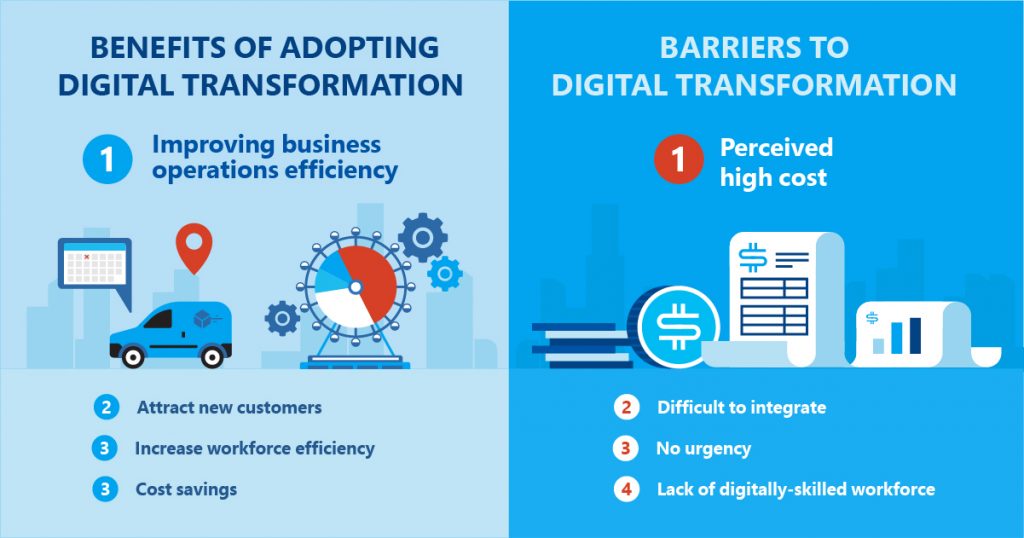

Digital Transformation – Small Steps

Do we Really Need Strategy For Cost Optimisation or Cost Reduction?

COVID-19’s impact: A fundamental change or a painful but short blip on Retail Fashion Industry of India?